Important Note: Our tools require that you affirm that you are a financial professional. By registering as a financial professional, you will be allowed access to professional materials, which are specifically intended for financial advisors, registered representatives of licensed security firms, financial planners and other financial and investment professionals. By clicking “Register” you certify that you are a financial professional with the requisite knowledge and experience to use this material appropriately. A “finance professional” does not mean you have to be formally employed by a financial services firm (e.g., individual investors are accessible); however, you do need to have a sophisticated financial skill set that a prudent person would consider to be deemed “professional.”

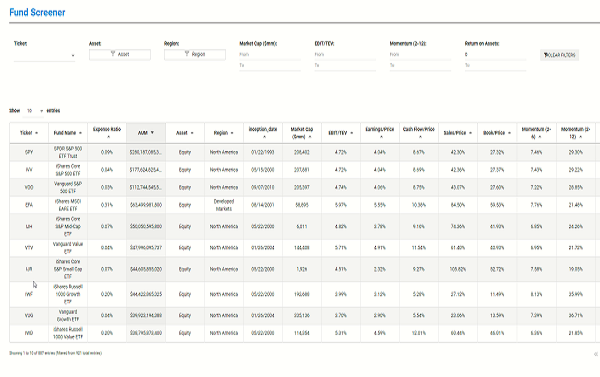

Please note that some tools (such at the stock screener) are no longer available because of regulatory and/or commercial burdens. We are sorry for the inconvenience.